Are you considering transferring banks or obtaining a new debit card? It could be challenging to choose the best debit card provider for you because there are so many options available.

Traditional high-street banks, brand-new digital banks, and other online money options are also available.

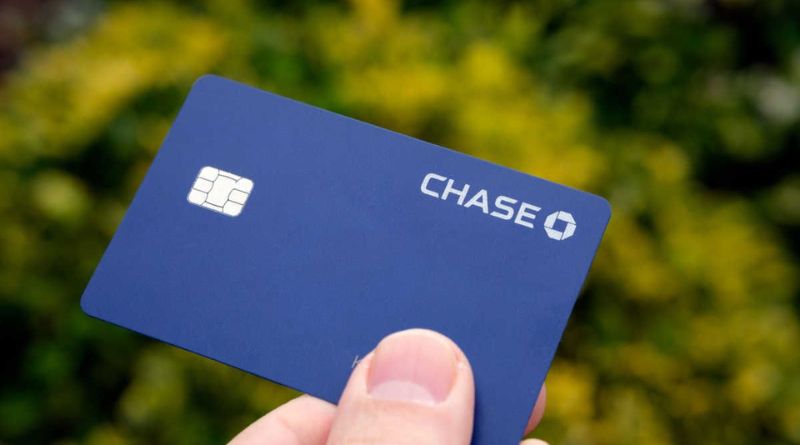

A well-liked choice is Chase, a US-owned bank that made its UK debut in 2021. Along with its current account, it provides a debit card, but what more does it offer? And most importantly, what is the price?

We’ll go over all you need to know about the Chase debit card in this article. This covers the accounts that are eligible for a card, in addition to features, costs, and spending and withdrawal caps. We’ll even examine the Chase card’s international usage.

Check out the money services company Wise if you’re searching for an affordable, practical card to use abroad.

With only a tap, you may make purchases in over 150 countries using the Wise debit card in local currency.

Every time you spend money overseas, your funds are changed at the mid-market exchange rate—all for a nominal currency conversion cost. There is nothing to pay if the money is already in your Wise account.

Chase debit card packages in the UK

When you open a current account with Chase Bank, you automatically receive a debit card. Next, we’ll examine the features and advantages of this account package so you can choose if it meets your needs.

However, you may anticipate the following card characteristics as normal, exactly like with other UK debit cards:

- Payments with contactless debit cards

- Using digital wallets like Apple Pay, Google Pay, and Samsung Pay with your card

- Availability of the Chase mobile banking app and online banking

The Mastercard payment network, which is widely recognized globally, is used by the Chase debit card.

Chase Current Account

The ordinary current account is the sole debit card bundle that Chase UK provides.

The account, which is intended for those in the UK who are above 18, has no monthly fees and is pre-loaded with a Chase debit Mastercard.

The card is numberless and contactless; for further security, the number is saved in the mobile app.

For a full year, the account also gives 1% cashback on regular purchases. This covers eligible purchases made both domestically in the UK and abroad.

Open a linked Chase saver account, which gives 4.1% variable interest on your savings, if you have a Chase current account.

Chase Bank provides additional capabilities in the app to make your money go farther, as well as round-the-clock assistance via the app or over the phone.

How does the Chase debit card work?

The Chase debit card functions just like other bank cards issued in the UK. It may be used to make cash withdrawals from ATMs both domestically and abroad.

Moreover, you may make purchases with your Chase card both online and at physical stores, eateries, pubs, and transportation hubs.

You may just touch to make purchases wherever you see the contactless icon since it is contactless. As an alternative, you can use the till’s payment terminal to input your PIN.

However, the card may not appear exactly how you’re used to. The typical 16-digit number is not written on the front or back of Chase debit cards since they are numberless.

This is so that only you can view the number, which is solely saved in your private mobile app. It’s an additional layer of protection to keep you and your money safe.

Rewards for spending are also available with the Chase debit card. You will receive 1% of your daily purchases, domestically and overseas.

Most transactions are eligible for cashback, except purchases made through estate agents, gambling, and antiques.

How to get a new UK-issued debit card from Chase?

You must first apply for a current account to receive a new debit card from Chase.

The Chase mobile banking app must be downloaded; it may be found on Google Play and the App Store. Then, to create your account, adhere to the app’s directions.

In addition to proof of address, you could be required to produce identification, such as a passport or driver’s license.

You may order your new Chase card using the app once your account has been opened.

Do you need a replacement Chase card but already own one? Your card might be lost, stolen, destroyed, or ingested by an ATM. In any event, using the Chase app, ordering a replacement card is simple. You may also use the app to freeze your card in case it has been lost or stolen, preventing anybody else from using it.

Debit card fees for Chase in the UK

What is the true cost of using a Chase debit card in the UK? In the UK, using it should be free of charge. Additionally, Chase guarantees that using the card overseas won’t result in costs.

Let’s examine the primary fees associated with Chase debit cards that you should be aware of:

| Transaction type | Chase fees |

| Maintaining the account | Free |

| Withdrawing cash in the UK | Free (ATM operators may charge their own fee) |

| Withdrawing cash overseas or in foreign currency | Free (ATM operators may charge their own fee + Mastercard exchange rates apply) |

| Debit card payments in GBP | Free |

| Debit card payments in foreign currency | Free (if you choose to pay in GBP, the merchant may apply a fee) |

| Replacement debit cards | Free |

When it comes to using your card abroad, Chase is far more affordable and accommodating than certain other banks.

However, Mastercard’s exchange rates will handle the currency conversion when you use your card to make purchases abroad.

These could be competitive, but there’s a good chance they’ll come with a premium above the mid-market exchange rate.

This is the one that credible currency websites or Google will point you toward.

Therefore, even in the unlikely event that Chase waives fees associated with foreign purchases or withdrawals, you may still be overpaying.

Check out the Wise debit card for consistently competitive exchange rates.

It works in more than 150 countries and instantly and markup-free converts your money to the local currency using the mid-market rate.

The conversion is just somewhat expensive and transparent, or it’s free if you already have the cash in your Wise account.

Chase Debit Card Limits in the UK

The Chase debit card does have some restrictions and limitations, much like other debit cards issued in the UK. These mostly relate to the daily limit on the amount of money you may take out of an ATM.

Let’s examine this:

| Transaction type | Limit |

| ATM cash withdrawal – daily | Up to £500 |

| ATM cash withdrawals overseas – monthly | Up to £1,500 |

| Contactless debit card spending | Up to £100 per transaction |

Debit Card Limits Abroad

One of the few UK banks that doesn’t charge you for using your debit card abroad is Chase. But before you fly, there are still a few things to think about.

First off, you may only withdraw a certain amount of money from foreign locations using your Chase card. Now, this is limited to £1,500 every month. Therefore, you might need to use a different card if you require additional spending money.

The contactless spending limit of the nation you are visiting should also be investigated. In the UK, it is £100; however, this may not apply to other nations. Thus, it’s wise to commit your debit card PIN to memory just in case.

Naturally, you should be aware of any additional fees when using your debit card that was issued in the UK abroad.

The shop may impose a surcharge if you decide to pay in GBP instead of the local currency. Even while Chase doesn’t charge a fee for international cash withdrawals, many ATM providers do. That covers all you need to know about the Chase debit card.

We’ve discussed how to obtain the card as well as the features and advantages that come with having a Chase account. This covers strategies to stretch your budget, such as access to savings accounts and rewards.

Additionally, the fees, limitations, and other information you should be aware of while using your Chase debit card overseas or in the UK.

Thus, you must be prepared to determine if the Chase debit card is the best option for you at this point.

Additionally, you might wish to use a different card, such as the Wise debit card, if you’d like one with transparent, low costs for ATM withdrawals and overseas purchases.